Benefit from the expertise of a pioneer in emerging markets

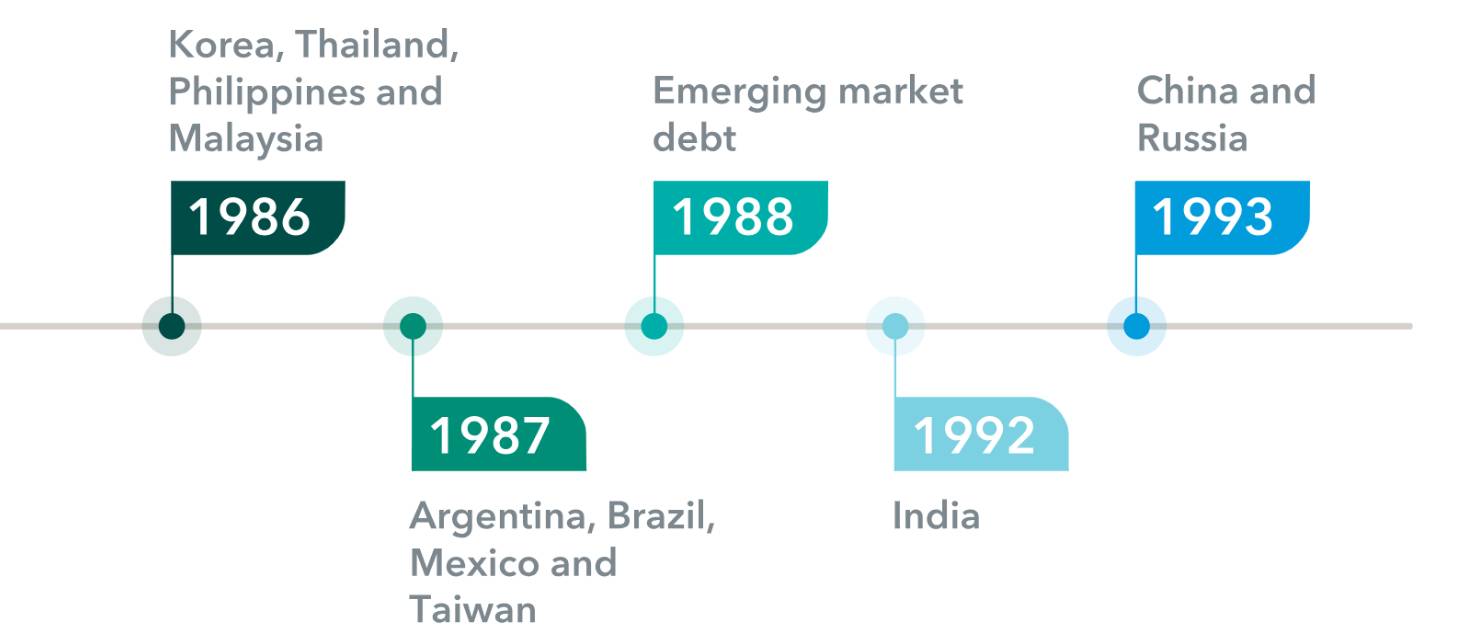

Our first investments in emerging markets

Scale and scope of our research

Deep research capabilities to unearth opportunities

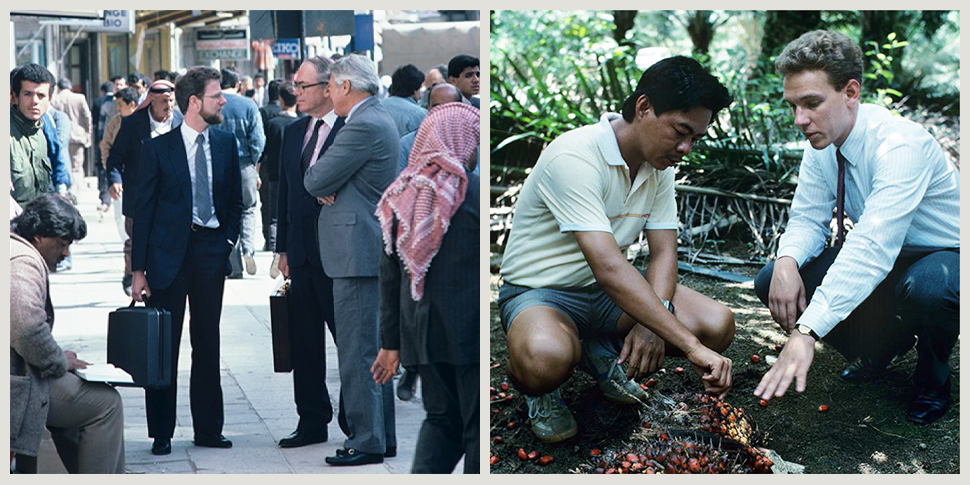

Our focus is and always has been on fundamental research. In addition to desk research and traditional field research, our analysts are encouraged to venture ‘off the beaten path’. Engaging directly with the companies we invest in has enabled us to make intelligent, well-informed, ‘bottom-up’ investment decisions.

LHS: Former Investment Professionals Peter Armitage (left), Tom Sorensen (center) and Bob Kirby (right) explore investment opportunities in Amman, Jordan in 1987.

RHS: Portfolio manager Rob Lovelace is briefed on crop conditions in Malaysia, 1989.

Boots on the ground

Few asset managers can match the scale and scope of our proprietary research effort. This allows us to seek out the best investment opportunities for our clients. In 2024, we conducted over 21,000 company meetings in over 50 countries, 28 of them being emerging market countries.

A long-term approach to EM investing

In our experience, investing successfully means taking a long-term view. We emphasise long-term investments in companies in order to determine the difference between the fundamental value of a company and its price in the marketplace.

While this approach may often involve taking a non-consensus view and willingness to ride out volatility, the expectation is that new information will come to light over time that validates our opinions and steers the consensus view in our favour.

Insights

Fresh perspectives from our investment team

Actionable ideas

Navigate markets with our range of EM portfolios

All data as at 31 December 2024 unless otherwise stated. Source: Capital Group

EM: emerging markets

Risk factors you should consider before investing:

- This material is not intended to provide investment advice or be considered a personal recommendation.

- The value of investments and income from them can go down as well as up and you may lose some or all of your initial investment.

- Past results are not a guarantee of future results.

If the currency in which you invest strengthens against the currency in which the underlying investments of the fund are made, the value of your investment - will decrease. Currency hedging seeks to limit this, but there is no guarantee that hedging will be totally successful.

- Some portfolios may invest in financial derivative instruments for investment purposes, hedging and/or efficient portfolio management.

Depending on the strategy, risks may be associated with investing in fixed income, derivatives, emerging markets and/or high-yield securities; emerging - markets are volatile and may suffer from liquidity problems.